Rio Tinto & Codelco $900M Chile Lithium Deal: Powering Energy Transition

Rio Tinto’s Strategic $900 Million Chilean Lithium Deal Strengthens Global Energy Transition Portfolio

[Salt lake in the Atacama region of Chile]

Salt lake in the Atacama region of Chile, similar to the Salar de Maricunga where Rio Tinto and Codelco will develop their lithium project. Image: Pixabay (CC0)

In a significant move that reinforces its position in the critical minerals sector, Rio Tinto has struck a deal worth up to $900 million with Chile’s state-owned copper giant Codelco to develop a high-grade lithium project in the Salar de Maricunga salt flat. The agreement, announced on May 19, 2025, marks Rio Tinto’s entry into Chile’s lithium industry and builds upon an existing strategic partnership between the two companies in copper mining.

Landmark Lithium Joint Venture in Salar de Maricunga

Under the terms of the agreement, Rio Tinto will acquire a 49.99% stake in Salar de Maricunga SpA, the company through which Codelco holds its licenses and mining concessions in the Maricunga salt flat. The investment will be structured in three phases:

- $350 million in initial funding for additional studies and resource analysis to progress the project to a final investment decision

- $500 million toward construction costs once a decision is made to proceed with the project

- $50 million if the joint venture achieves its goal of delivering first lithium by the end of 2030

The Salar de Maricunga represents Chile’s second-largest lithium resource after the Salar de Atacama and is known for having one of the highest average grades of lithium content in the world. The project offers potential for scalable, long-life, and low-cost production, making it a strategic asset in the global lithium supply chain.

Rio Tinto Chief Executive Jakob Stausholm emphasized the significance of the partnership: “We are honoured to be chosen as Codelco’s partner to deliver a world-class project using Direct Lithium Extraction technology in the Salar de Maricunga, leveraging our expertise as a leading producer of lithium for the global market. Developing this significant lithium resource will deliver further value-adding growth in our portfolio of critical minerals essential for the energy transition.” [(https://www.riotinto.com/en/news/releases/2025/rio-tinto-partners-with-codelco-to-develop-lithium-project-in-chiles-salar-de-maricunga)]

Direct Lithium Extraction: A Sustainable Approach

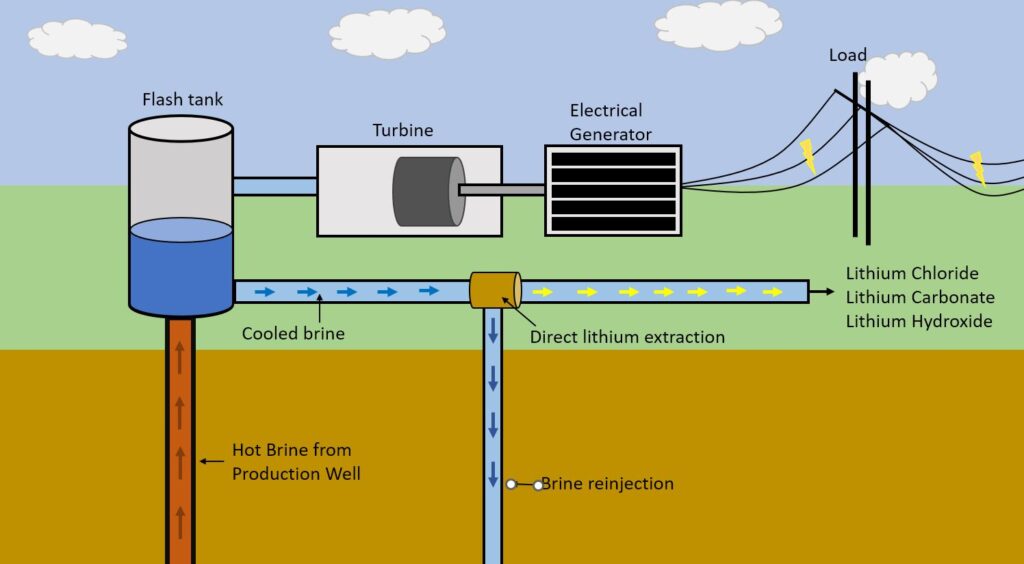

[Lithium brine extraction process diagram]

Diagram showing lithium brine extraction process. Image: Wikimedia Commons (CC BY-SA 4.0)

A key aspect of the Maricunga project is the planned use of Direct Lithium Extraction (DLE) technology, which represents a significant advancement over traditional evaporation pond methods. DLE offers several substantial benefits:

- Reduced land footprint compared to conventional evaporation ponds

- Significantly lower water consumption in the water-scarce Atacama region

- Higher lithium recovery rates, potentially exceeding 90% versus 40-60% for traditional methods

- Accelerated production timelines, reducing extraction time from 18+ months to potentially weeks

- Ability to return most of the brine water back to the salt flat after lithium extraction

“The joint venture will focus on deep engagement with the local communities, supporting the development of infrastructure such as power and roads, and applying leading extraction, processing and re-injection technologies to the project to maximise the recovery of minerals and minimise its environmental footprint,” Rio Tinto stated in its announcement. [(https://www.riotinto.com/en/news/releases/2025/rio-tinto-partners-with-codelco-to-develop-lithium-project-in-chiles-salar-de-maricunga)]

This approach aligns with growing global demands for more sustainable mining practices, particularly in lithium production, which has faced criticism for its environmental impact in traditional operations.

Expanding the Rio Tinto-Codelco Strategic Partnership

The lithium deal builds upon an existing strategic partnership between Rio Tinto and Codelco in copper mining. Just a week before the lithium announcement, on May 12, 2025, the companies revealed plans to strengthen their collaboration in developing a copper mining district in the Atacama Region around their Nuevo Cobre joint venture.

Nuevo Cobre, established in 2023, is a copper exploration project with Rio Tinto holding 57.74% ownership and Codelco 42.26%. The project is located approximately 10 kilometers southeast of the Potrerillos smelter in Chile’s Atacama Region and is adjacent to Codelco’s wholly-owned San Antonio property. [(https://discoveryalert.com.au/news/codelco-rio-tinto-nuevo-cobre-mining-2025/)]

The expanded copper collaboration includes:

- Formation of a joint committee with equal representation from both companies

- Equal funding for preliminary conceptual studies over an initial 12-month period

- Exploration of operational synergies and shared infrastructure opportunities

- Potential for integrated water conservation strategies and renewable energy implementation

Máximo Pacheco, Chairman of Codelco, highlighted the importance of the partnership: “Collaboration is a fundamental pillar of sustainable mining. It’s the best way to meet the challenges of increasingly demanding projects. In this case, two global industry leaders are joining forces to unleash the full potential of this mining district.” [(https://www.codelco.com/en/codelco-y-rio-tinto-acuerdan-fortalecer-la-colaboracion-para-el)]

Strategic Significance for Chile’s Mining Sector

The dual partnerships in lithium and copper carry significant strategic importance for Chile’s mining sector and broader economy. Chile has historically been the world’s largest copper producer and until 2017 was the top lithium producer globally before being surpassed by Australia.

For Codelco, traditionally focused on copper, the lithium partnership represents a key component of its diversification strategy. “This project continues our lithium diversification strategy, which is essential for the energy transition, with a world-class partner in Rio Tinto that represents the most attractive option for Codelco and the country,” said Pacheco. [(https://www.riotinto.com/en/news/releases/2025/rio-tinto-partners-with-codelco-to-develop-lithium-project-in-chiles-salar-de-maricunga)]

The partnership with Rio Tinto gives Chile’s lithium industry significant momentum in its efforts to reclaim global leadership. As Cesar Perez, an analyst at BTG Pactual, noted: “This joint venture accelerates the country’s strategic objective to reclaim leadership as the world’s top lithium producer, while allowing Codelco to diversify its portfolio.” [(https://www.reuters.com/markets/commodities/chiles-codelco-taps-rio-tinto-major-new-lithium-tie-up-2025-05-19/)]

Rio Tinto’s Expanding Lithium Portfolio

[Salt flat in the Andes mountains of Chile]

Salt flat in the Andes mountains of Chile, showcasing the unique landscape where lithium extraction takes place. Image: Pixabay (CC0)

For Rio Tinto, the Maricunga deal represents the latest step in an aggressive expansion into lithium, positioning the company as a major player in the energy transition materials sector. This strategy has included:

- The $825 million acquisition of the Rincon lithium project in Argentina in 2021

- A $2.5 billion investment announced in December 2024 to expand the Rincon project

- The $6.7 billion acquisition of Arcadium Lithium, completed in March 2025

- Formation of a dedicated lithium business unit within Rio Tinto’s corporate structure

“Rio has sought to accelerate building a South American lithium business from a starting position as a non-producer,” J.P. Morgan noted in an analysis of the deal. “Rio’s partnership with Codelco will expand its lithium footprint into Chile,” cementing a wider regional strategy across the lithium-rich “triangle” of Chile, Argentina, and Bolivia. [(https://www.reuters.com/markets/commodities/chiles-codelco-taps-rio-tinto-major-new-lithium-tie-up-2025-05-19/)]

Lithium Market Context and Timing

The timing of Rio Tinto’s lithium expansion is notable given recent market conditions. After reaching record highs in 2022, lithium prices have fallen significantly, with lithium carbonate prices dropping below $10,000 per metric ton in early 2025, a four-year low. [(https://carboncredits.com/lithium-prices-crash-below-10k-hitting-a-4-year-low-will-the-market-rebound/)]

However, industry analysts project a potential supply deficit as early as 2026-2027, driven by accelerating demand from electric vehicles and energy storage systems. According to recent forecasts, lithium supply growth is projected at approximately 17% in 2025, but with energy storage demand potentially growing at a faster rate. [(https://www.nasdaq.com/articles/lithium-market-update-q1-2025-review)]

By investing during a period of lower prices and positioning for production later this decade, Rio Tinto appears to be taking a long-term strategic view of the lithium market, anticipating the projected supply constraints as global electrification accelerates.

Environmental and Community Considerations

Both companies have emphasized their commitment to responsible development practices in the environmentally sensitive Atacama region. The joint venture plans to focus on:

- Minimizing water usage through advanced technologies and recycling

- Developing shared infrastructure to reduce environmental footprint

- Engaging deeply with local communities, including indigenous populations

- Supporting regional economic development beyond direct mining employment

These commitments are particularly important given growing concerns about the environmental impact of lithium extraction in Chile’s salt flats. Traditional evaporation pond methods have faced criticism for their high water consumption in the already arid Atacama region, making the planned use of DLE technology a potential game-changer for more sustainable lithium production.

Timeline and Next Steps

The lithium transaction is expected to close by the end of the first quarter of 2026, subject to regulatory approvals and other customary closing conditions. Following closure, the joint venture will work to:

- Update the declared reserves and resources for the Maricunga project

- Advance studies to inform future investment decisions

- Develop implementation plans for DLE technology

- Engage with local communities and stakeholders

The partners have targeted making a final investment decision before the end of the decade, with the goal of delivering first lithium production by the end of 2030.

A Strategic Partnership for the Energy Transition

[Hexagonal patterns in salt lake of Atacama Desert]

Hexagonal patterns in a salt lake of the Atacama Desert, Chile. Image: Pixabay (CC0)

The dual partnerships between Rio Tinto and Codelco in lithium and copper position both companies to play pivotal roles in supplying critical minerals for the global energy transition. As Jakob Stausholm noted, “We aim to bring significant investment and long-term benefits to the Atacama region as we advance Maricunga and Nuevo Cobre together, with a focus on responsible sustainable development including shared infrastructure and solutions to minimise water usage.” [(https://www.riotinto.com/en/news/releases/2025/rio-tinto-partners-with-codelco-to-develop-lithium-project-in-chiles-salar-de-maricunga)]

With copper demand projected to rise significantly for electrification infrastructure and lithium remaining essential for battery production, these strategic moves appear well-aligned with long-term global trends despite near-term market fluctuations.

The collaboration also demonstrates how state-owned enterprises and multinational mining companies can effectively combine their strengths to develop resources more efficiently and sustainably than either might achieve independently.

As the energy transition accelerates globally, this strategic partnership between Rio Tinto and Codelco could serve as a model for future resource development collaborations that balance economic, environmental, and social considerations in mining critical minerals.

Have you seen other major mining companies making strategic moves in critical minerals for the energy transition? Share your thoughts in the comments!